When you are in a financial bind or find yourself having trouble making ends meet, financial resources may be limited. Often marketed as easy ways to obtain cash quickly, installment loans and payday advances may seem like a welcome relief to your money

woes. But before you apply for one of these loans, be aware that these options may end up costing you instead of providing the funds you so desperately need.

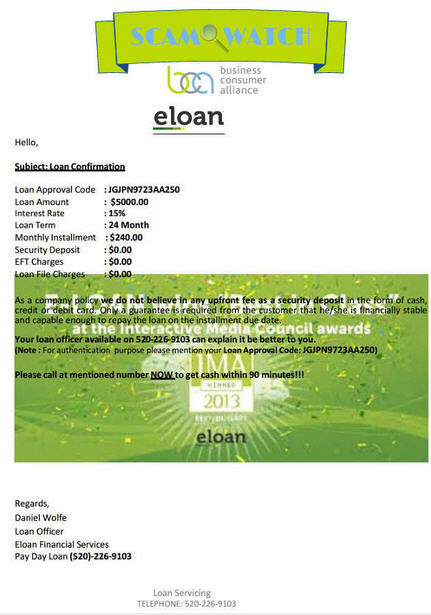

For example, take customers that applied for installment and payday loans with eLoan Financial Services (“EFS”), of Elgin, Illinois. Borrowers reportedly

applied for loans with EFS and were informed they would have to pay a fee before funds could be deposited. EFS required fees ranging from $135 to $165 initially to be loaded onto a Green Dot Money Pack or Vanilla Reloadable Pack to secure the loan. After providing

the “lending agent” with the reload codes, no loans were deposited, which created more financial troubles for the unsuspecting borrowers, who were now out the money they spent.

One consumer who initially obtained a Green Dot Money Pack for $161 for a promised $4,000 loan was told their account rejected the loan. To receive the funds they would have to send additional money to cover taxes and activate the transaction through Western

Union. After stealing over $800 from this customer, EFS tried to have the victim send approximately $400 more to have $5,000 deposited into their account. When a refund was requested, EFS flat-out refused.

EFS is one of many scammers that have popped up over the years, misleading desperate individuals to pay advance fees for loans they never deliver. The swindlers behind EFS have a history of impersonating actual businesses to bilk individuals out of their

money. A look at F-rated EFS’s Business Consumer Alliance (“BCA”) reliability report shows the various names they have used in their scheme. E-Loan, Inc. (“E-Loan”), headquartered

in New York, appears to be one of the latest companies spoofed by the criminals. When we contacted E-Loan with the complaints, they kindly informed BCA that they have no affiliation with EFS and at present do not offer loans to consumers. E-Loan has also placed

a security alert on their website regarding the scam, which can be viewed on their BCA storefront.

If you find yourself in a financial bind, before seeking the services of an advance fee loan company like EFS, or a payday lender, consider alternatives such as:

- requesting an extension or payment arrangement;

- applying for a small loan from your banking institution;

- borrowing the funds from someone you trust or selling items that you own;

- seeking credit counseling or financial advice to create a budget and repayment plan for your debts.

Always obtain a reliability report from BCA to check out the company’s reputation and their complaint history. Avoid and steer clear of any lender that requires you to pay fees in advance before

providing a loan. This practice is illegal in the United States and Canada. If you have been swindled by an advance fee loan company or payday advance operator, file a complaint with BCA.

For more information and tips on

Advance Fee Loans and

Payday Loans, check out our BCA resource guides.

About the Author

Nicole Pitts is a Senior Business Analyst and Editor for Business Consumer Alliance. She has been with the organization for 12 years and specializes in report writing, business evaluation, and investigations. Nicole corresponds with businesses regarding

complaint trends and provides suggestions to help them alleviate problem areas that may cause concern. She also conducts advertisement reviews, reports on government enforcement actions, and assists government agencies and the media in obtaining information.

She enjoys reading, movies, and spending time with her family. Nicole can be reached by email at npitts@businessconsumeralliance.org.